Whenever finances are short, cash advances can offer instant funds.

Understand what forms of charges you will be in charge of. You need to know very well what you will definitely want to spend later, even if you could really would like and need the funds. Ensure that you request a written verification of papers about your charges.

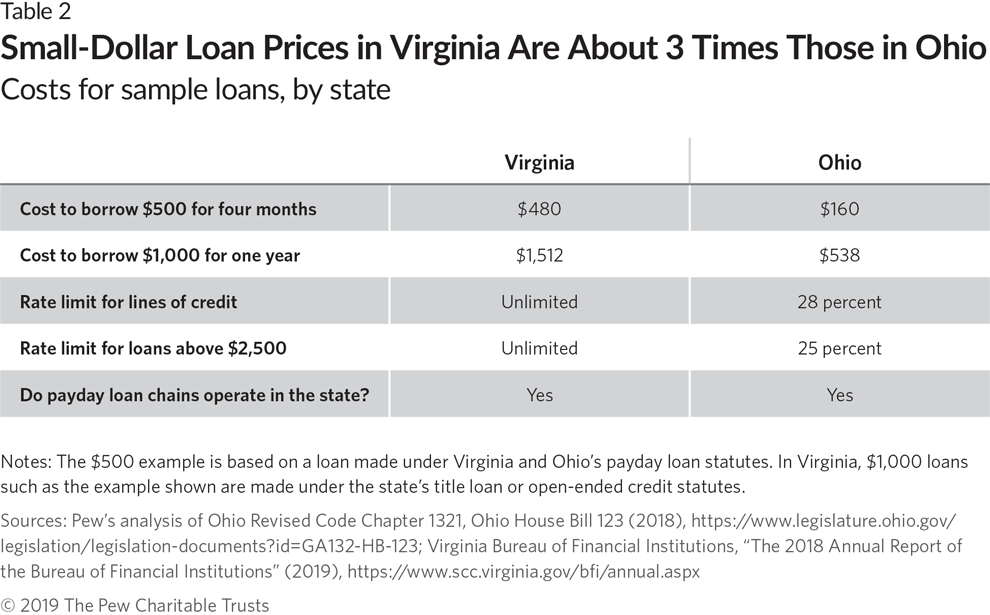

Spend loan companies have various methods to get around monthly interest laws that protect consumers day. They will charge fees that are outrageous essentially figure to interest concerning the cash lent. This will increase rates of interest just as much as over 10 times the interest levels of every typical loan that you merely would get.

Payday cash advances can provide a great response to people that are in desperate need for cash. If your wanting to join and getting the money, individuals should comprehend what exactly is tangled up in an advance loan. Interest fees tend to be quite high combined with costs could make such loans hard to pay for the re re payments.

Take a look at all charges very very carefully by making use of a cash advance loans. This may enable you to precisely find out what you’ll owe when you borrow the bucks. You will discover month-to-month interest laws that are able to keep customers as you safeguarded. Pay day loan businesses attempt to travel stuff like this by increasing their costs. This causes it to be price of cash merely to borrow a little. It will help you find out if acquiring that loan is certainly a necessity that is absolute.

Constantly understand your entire choices prior to deciding to secure a cash advance. It is in reality cheaper getting that loan from a bank, bank cards business, plus your charge card. Payday advances charge higher fees and prices that may allow you to get into much more trouble that is financial.

Indirect loans could have additional charges so they are able to come up with a profit whenever you pay it back because they have to keep a few of the money.

Will never be mistaken you have got gotten a pay loan day. You need to constantly keep all paperwork close on hand so you might maybe not fail to make payments that are timely. Failure to generally meet the deadline you could end up being billed a lot of cash.

You’ll want to most likely prevent them anyhow if they can perhaps maybe maybe not know straight away in this electronic globe you money whether they will certainly loan.

Just look after individuals who provide payday loan providers and also require deposit that is direct. This is actually the organization by having large amount of funds for you.

Make sure you comprehend the amount that is exact payday advance will cost you. We all know that pay day loan organizations will connect extremely interest that is high. They might additionally tack on administration fees whenever thinking about taking out fully a loan.The costs are concealed in terms and conditions.

Research the BBB’s internet site just before are seeking information about a business. Not absolutely all the company is mostly about the up and trustworthy.

Those likely to get a payday loans online need to do research before filling an application away. Don’t make the loan that is initial business you will find. Compare the one that is best.

You need to explore other choices that are available you might need more cash that what you are actually able repay because time frame. You might find other programs that could be prepared to work alongside you on payment timetables and re re payment quantities.

Realize that the effective interest rates on payday improvements are as much as 651%. This number differs but generally payday advances have a higher. It may you need to be hidden in fine print.

Ahead of picking  to take a money advance, think long and difficult. Recognize that most loans charge A apr that is standard over pay check loan is between 378-780%. Take into account that borrowing $500 or even more for 14 days. Then it may be an excellent choice if it’s your best way out from a jam.

to take a money advance, think long and difficult. Recognize that most loans charge A apr that is standard over pay check loan is between 378-780%. Take into account that borrowing $500 or even more for 14 days. Then it may be an excellent choice if it’s your best way out from a jam.

Nonetheless, you may expect having to pay more for this type of loan, a quantity more than 20 percent is much too steep and also you have to look somewhere else.

Don’t say yes to such a thing just before carefully see clearly thoroughly. Look at regards to the amount of money and obtain any relevant concerns you may have. Look somewhere else if you’re confused or see concealed fees and wordy terminology which could mask fees that are questionable.

Frequently just just take down an online payday loan for the quantity that you’re able to pay for right right right back. You can’t assume that luck shall help you repay .Any stability remaining that you must expand over into another paycheck period will simply consume much more using your next paycheck.

You need to spend a pay day loan off right right back using the date that they’ll show you it is due.

Payday loan providers are a rather industry that is rich. Lenders are expensive and it is all revenue for the dough. Research about each loan provider to ensure you will be becoming the essential effective rate feasible. You need to think of all charges which are from the loan.

Be sure that you look after your money advance first once you get your following paycheck. You will probably look for a late or missed payment. Make sure that you understand precisely how money that is much growing from your own future paycheck which means this responsibility is met immediately.

Constantly make certain you are working with a lender that is reputable you are going trying to find companies that offer unsecured guarantor loan. There are lots of businesses which exist that will just rob you blind. You’ll want to prevent them without exceptions.

Payday advances at Focus Financial Inc. are easy and simple they shell out quickly. They can price a complete great deal to repay.To have the funds you prefer with a reduced expense or zero cost, you really need to think of asking a number of family, think of asking family members for assistance.

Should your just other method of acquiring cash will definitely cost higher than a pay day loan.By method of instance, you might have cash tangled up within the CD, cash advances may be properly used even.

Payday loans could possibly be a fantastic back-up plan in case of an emergency that is economic. You must know every thing included before you dive appropriate in. Making use of these advice on hand, you shall bear in mind what you ought to understand.